The Professor explains economics.

You have arrived at www.politicalart.co.uk

where The Professor likes to joke and amuse.

But he is concerned about inequality and the fact that

it continues to rise and has reached unbelievable levels.

He discusses the resulting political, social and ecological consequences of inequality

in 4 parts using wacky pictures.

PART 1 Inequality

Inequality is increasing between countries.

It is also increasing within the developed world,

within poor countries

and within countries with fast growth such as India and China.

Zero hour contracts.

Unaffordable housing.

Food banks and people sleeping rough .

Austerity and cuts in social provision.

Poverty, malnutrition and disease

are common in many countries.

Many have no clean drinking water.

Mass migrations.

People risking their lives

to escape war and poverty.

Inequality is increasing but global wealth is also increasing, albeit at a slowing rate.

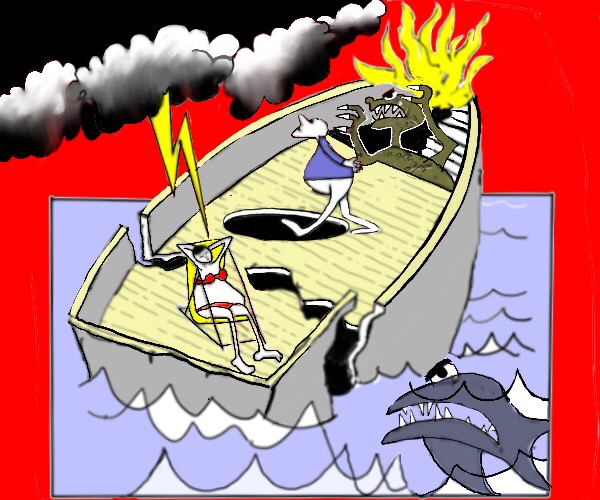

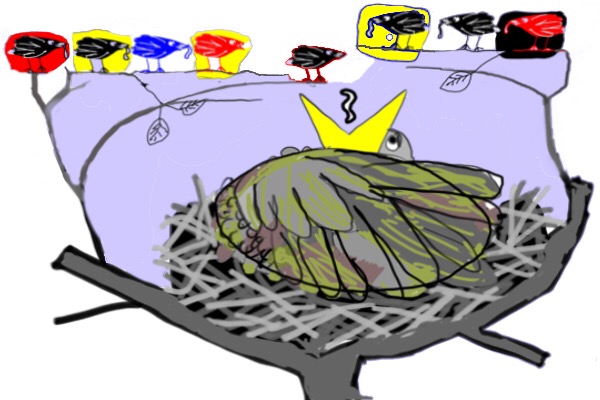

To justify inequality the argument is made that everyone gains when world wealth is increasing.

It is said that all boats rise.

So inequality is a price worth paying?

However this ignores the high price that the world economy pays for inequality.

PART 2 The price that the world pays for inequality.

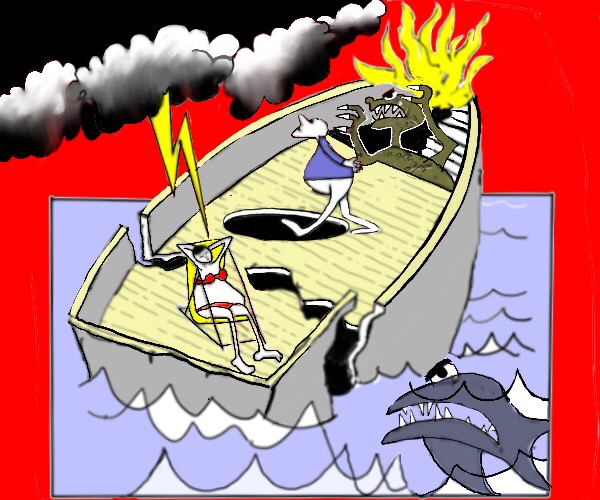

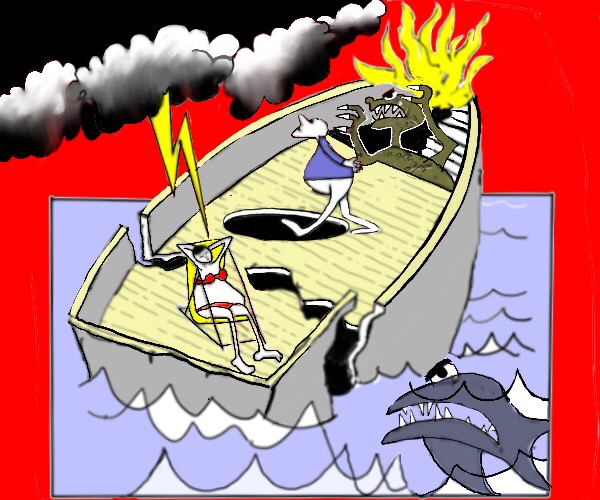

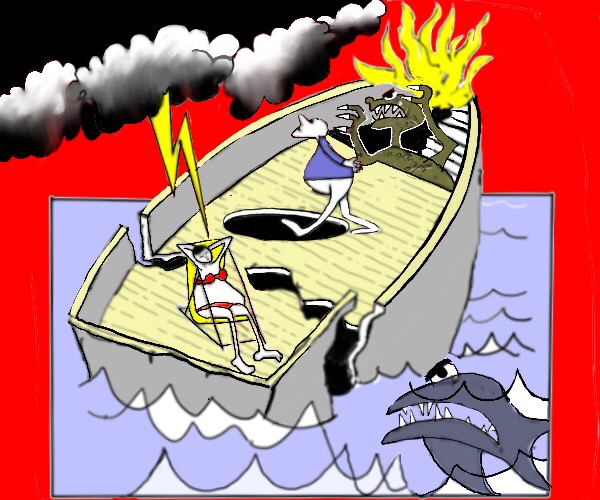

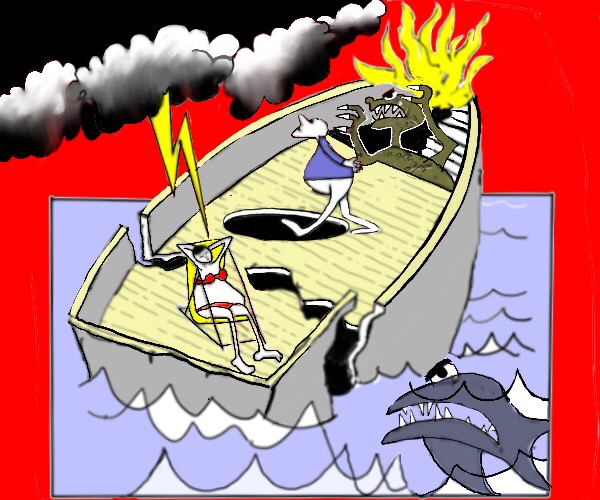

THE WORLD ECONOMY IS IN A MESS.

It is on life support.

Inequality is a serious moral issue.

but as well as that it generats disasterous economic outcomes.

It threatens the very system that creates it.

The Professor explains that this is

because

because

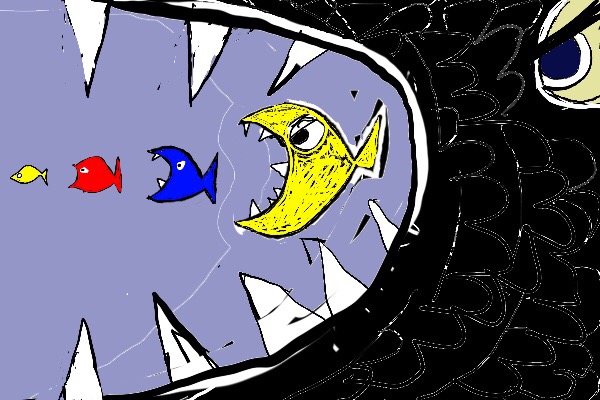

the world economy is unbalanced by too much wealth in too few hands.

Like a thousand cream dougnuts in one sitting,

this wealth is a huge moutain of excess capital

that chokes, clogs up and overwhelms the system.

The professor says that the rich have so much that they can hardly consume more.

So they invest, invest and invest.

A vast array of organisations invest, from small concerns

to multinationals,from financial institutions to countries with a surplus of funds.

Often they do not invest but hoard and so bank their spare cash.

It then gets recycled and loaned out again for consumption and investment.

Most people in the world cannot consume more as they have insufficient money.

Hence there is too much investment and not enough consumption.

Investment produces output so more is made than can be sold.

Where can all this production go if it is not used?

It is wasted. Wealth that has no use gets destroyed.

Waste is the way the economic system destroys wealth.

Unsold goods,

closed down and half used factories

and unemployment.

Insufficient sales hit profits.

profitable ventures become scarce relative

to the mountain of capital searching for reward.

Investment is cut back due to insufficient profits from production.

Global output slows.

Prices fall when

there is an abundance of goods and services for sale,

but people do not have enough money to buy them.

This is known as deflation.

Many countries have recently suffered

bouts of deflation or near deflation.

However big profits are instead made from the mountain of surplus wealth

diverted from production into assets.

While there are deflation tendencies, there is also asset price inflation

as the wealthy use their spare cash

to buy assets such as shares, property and bonds.

Too much money chasing these assets pushes up their price.

Property is an asset and prices have rocketed

causing a housing crisis.

Buy a home? Unaffordable.

Rent? Impossibly costly.

There is much homelessnes.

.

There is too much money! (for the rich that is)

Interest rates are the price of money,

hence this oversupply of money causes interest rates to be extremely low.

Some central banks, hoping to stimulate their economies,

lent money at negative interest rates. Some still are doing so.

Small savers are therefore penalised

and lose money with interest rates below inflation.

Extremly low low interest rates encourage borrowing.

The result is that world debt has got

completely out of hand reaching record levels.

With insufficient growth

debts cannot be repaid.

Slow global growth therefore threatens

another financial crisis.

Crises happen when unpaid debts cause economic disruption

leading to more unpaid debts and bankruptcies

cascading through the system.

The system desperately needs growth to keep it going.

However this wish for growth comes up against a harsh reality.

Growth eats into the world's resources and threatens sustainability.

Enviromentalists are aware of the struggle for growth.

However some are still not awake to the idea

that it stems from the drive for profits.

Can we have an economy not dominated by the profit motive?

What would it look like?

Suggesting technical fixes for unsustainability

is a way of sidestepping this question.

PART 3 Why inequality?

Let's see why.

Some people are paid a great deal

while others hardly anything.

There are also other important drivers of inequality.

Investors get the profits

made by those that do the work and produce the output.

The other way that inequality arises is through a transfer of wealth

from those without assets to those with assets.

The transfer is from the poor to the rich.

The rich gain from rent and

The rich gain from rent and

interest on loans for tuition fees, mortgages and for other needs.

The wealthy also gain as share prices and property prices rise.

Monopolies, or near monopolies maximise their profits by fixing prices.

They also exploit smaller firms.

Big powerful countries are able to exploit developing countries.

They do this by setting the terms and rules of doing business

to the advantage of their major corporations.

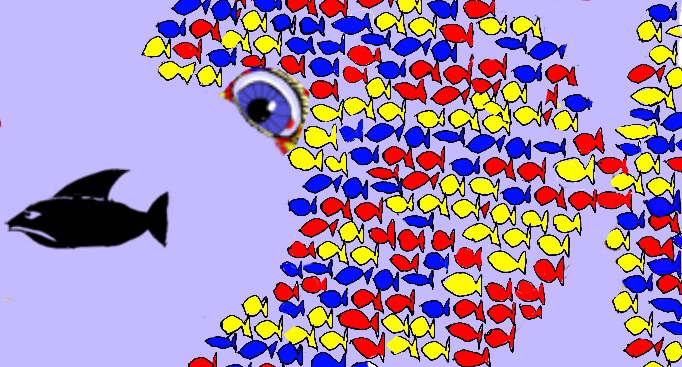

Big firms dominate small firms.

Developed countries dominate developing countries.

The powerful dominate the weak.

Inequality increases.

PART 4 What to do?

The situation has reached a tipping point.

People are angry and want change.

The establishment is being challenged.

There is a rise of political parties of both left and right.

The elite are seen as self serving and corrupt.

Politicians and the media are not trusted.

Many ruling elites and their governments are responding by dividing and ruling,

fostering ethnic and religious tensions

and by stoking the fires of war.

People must unite for a

more just society.

The answer is very simple.

But it is completely revolutionary.

It is DEMOCRACY.

Not the sham democracy where voting changes nothing

because powerful corporations and extreme wealth exert control behind the scenes.

That democracy is just theatre.

A true democracy is needed which is

for the people, by the people and of the people.

The people must run the show and be totally in charge.

This proposition is so extreme that few take it seriously.

The idea that those that produce the world's wealth should control it

and use it in their own best interests

is so difficult to imagine.

Could it work?

The alternative is increasing crises as output is unsold.

Profits are hit.

Investment is cut back.

The money goes into finance where better profits can be made but at the risk of instability.

Everyone suffers from the inevitable crises.

The mechanisms for achieving the goal of true democracy will evolve

and hopefully grow as the present system becomes more and more untenable.

For a society that works for the majority the immediate tasks are:

people having more control and ownership at the workplace.

draconian trade union laws scrapped,

a redistribution of wealth,

a halt to interference in other countries, economically, politically or by using force,

Those opposed are tiny in numbers.

We are many and are strong when united.

For now we are STUCK with

a system that is failing.

But a new healthy economy awaits.

How the economy works and why it doesn't

The Professor welcomes you to his other website

where, with lots of pictures

he explains in simple terms the basics of

how the economy works

and

why it doesn't.

www.whyitdoesnt.com

to get to the website.Cartoon Gallery

Pete, sometimes known as PEET, has another website.

It is a gallery of some of his cartoons.

Click on

www.peetcartoons.com

to get to the Cartoon Gallery .

The Professor and Pete hope you enjoyed the images.

They would both welcome suggestions and feedback.

Please forward this website to your friends.

Return to the start of this website.